World Connector Market Handbook

After growing 7.8% in 2022, the connector industry faced difficult times in 2023, declining -2.7%. Did all market sectors and product types decline, or were some able to weather the turbulent times of 2023 better than others?

- With connector sales declining in 2023, did all regions lose sales dollars or were some regions able to weather the storm and show growth? How will these same regions perform in 2024, in 2029?

- Which market sector or sectors showed the greatest growth in 2023, and which showed a decline? How does this compare to past years? How are these same markets anticipated to perform five-years from now or will other market sectors out-perform them?

- Over the last 10 years, certain product types have grown more than others. Are fiber optic connectors still anticipated to show greater growth than other types? How will the drive towards electric vehicles affect the growth in the power/high voltage connector market? Will the ongoing political and economic woes many countries are facing affect the growth in the military market, the consumer market?

This report analyzes connector industry sales from 2014 through 2023, with preliminary forecasts for 2024 and 2029. the World Connector Market Handbook details connector industry sales by region, end-use equipment sector, and product type. Utilizing tables and graphs, key statistics are provided for total world, as well as by region of the world.

2024 World Cable Assembly Market

A year marked by high inflation, worldwide geopolitical conflicts, high interest rates, housing and raw material shortages and low unemployment, 2023 was a year like no other! How did these factors affect the cable assembly industry, and will they continue to affect cable assembly performance over the next five-years?

- After contracting in 2023, will the industry rebound, and which markets will profit the most from this rebound?

- Which regions, markets, and cable assembly types have the highest growth prospects? Are any regions, markets, or cable assembly types anticipated to show a decline?

- What technical and economic trends are affecting the cable assembly industry?

- What cable assembly types are being used by market sector and region?

- Where should business investments be focused?

Constantly evolving technology is having a profound effect on the design and implementation of cable assemblies. Discover which cable assemblies will benefit most from this evolution and where to focus investments. Order your copy of 2024 World Cable Assembly Market now.

Connector Industry Forecast 2023-2028

2023 has proven to be a year of worldwide conflict and declining connector sales. Are sales anticipated to decline in all regions and market sectors in 2023 or will some fare better? Will growth return in 2024?

- How is the connector industry anticipated to perform in 2023? In 2024? What factors are predicted to contribute to the decline of sales in 2023? Will these same factors affect growth or decline in 2024?

- Which regions, market sectors and subsectors are predicted to show the greatest growth in 2023, in 2024 and in 2028? Which market sectors and subsectors, if any, are anticipated to grow or to contract?

- What outside factors are contributing to connector growth or decline in 2023? In 2024? What factors may affect growth beyond 2023?

- In what way are currency fluctuations impacting connector sales? How is connector backlog changing during the second half of 2023?

Bishop & Associates’ newest research report, the Connector Industry Forecast looks at past sales and reviews total world connector sales in 2022, providing a comprehensive analysis by region and market sector of projected connector sales for 2023 through 2028. With connector sales broken down by region, market sector and subsector, this report provides a detailed analysis in US dollars of the world connector industry.

Connector Types and Technologies Poised for Growth

What Connector Types and Technologies Are Poised to Grow the Most over the Next Five Years?

- Which existing connector types are poised for exceptional sales growth?

- What new electronic products and technologies are driving the growth in connectors?

- What potentially disruptive technologies may impact connector design and utilization over the next five years?

- How is growth in technologies like Artificial Intelligence (AI) driving the expansion and upgrading of data centers?

- What are the advantages of co-packaged optics as a solution to next generation 51.2 and 102.4Tb/s switches?

Top 100 Connector Manufacturers

In 2022, the Top 100 Connector Manufacturers Accounted for Almost 86% of the Total Electronic Connector Market.

- How does this compare to 2021? What percentage did the top 50 account for? The top 10? Who were the top 10 manufacturers? What percentage of the market did they account for?

- Who were the top 100 connector manufacturers in total sales? Which region accounted for the largest percentage of top 100 connector manufacturers based on origin?

- Which connector manufacturers had the greatest sales in the telecom/datacom sector, the industrial sector, or the automotive sector?

- Who was the leader in RF connector sales, I/O rectangular or circular connector sales?

- By base of origin, in which region do the largest connector manufacturers reside?

- Which connector manufacturers showed the greatest year-over-year growth, the greatest year-over-year decline?

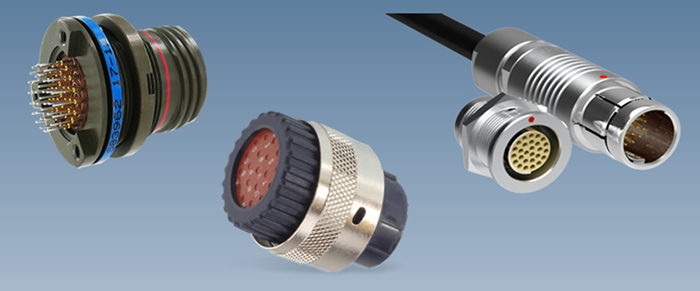

World Circular Connector Market 2023

In 2022, circular connectors represented $5.8 billion of the $84.1 billion connector market. What types of circular connectors made up this $5.8 billion? Will those same types represent the anticipated $7.7 billion in 2028?

- What types of circular connectors represented the greatest sales dollars in 2022? In 2023F? What type are anticipated to represent the greatest sales dollars in 2028F?

- Which region is the largest consumer of circular connectors overall? Of MIL-spec or COTS equivalent circular connectors? Of commercial or industrial circular connectors?

- What properties classify a circular connector as commercial or industrial? What is the potential for new connectors such as MIL-DTL-32689 (micro-MIL-DTL-38999) and M8 & M12 for SPIE?

- What is the difference between a MIL-spec connector and a COTS equivalent connector? What Mil-Specs mandate special anti-counterfeit marking?

European Connector Market 2021, 2022, 2023F, and 2028F

In 2022, Europe accounted for over 20% of worldwide connector demand.

- Which European countries/regions drove this demand? Which countries/regions are anticipated to drive this demand in 2023?

- What market sectors outperformed the average (European) market and which sectors underperformed?

- Which European countries/regions and market sectors will offer the best growth prospects over the next five years?

- What are the leading product categories within specific end-use equipment markets?

- Who are the leading connector manufacturers in the European connector market?

- How does the FX market affect the European connector market?

Connector Industry Yearbook

Each year, Bishop & Associates prepares the Connector Industry Yearbook based on annual reports provided by publicly traded connector companies. Income statements and balance sheets are consolidated for the past 10 years, five years, and most current year, providing benchmarks on the industry and the overall performance of the public connector companies. The report also provides a high level overview of the connector industry from 2012-2022 and a 2023 and 2028 forecast for sales by region of the world and by end-use equipment sector. The world electronic connector industry was $49.8 billion in size in 2012. In the 10 years since, the industry has achieved a compound annual growth rate (CAGR) of +5.4% with worldwide sales of $84.1 billion in 2022.

World RF Coax Connector Market 2023

- How did the RF coax connector market perform in 2021? How will it perform in 2022, in 2027? What markets and geographical regions present the greatest potential for growth in RF (coaxial) connectors and why?

- How do new and higher frequency allocations, especially for 5G/6G and IoT, influence design, production tolerances, test equipment, and cost and supply chain sourcing? How has advanced technologies influenced RF connector design?

- Which specific RF coax connectors (families and product types) are projected to show the highest growth and how are connector manufacturers addressing these potential increases or decreases in demand?

This report provides the latest and most up-to-date market information, trends, RF connector technology, product, and application information.

Military Ground Vehicle Market for Connectors

Military ground vehicles play an important role in today’s military operations. They transport troops, fuel, and military supplies to a battlefield that is becoming more and more connected. How are military ground vehicles adapting to handle this connected space?

- The military ground vehicle market for connectors is anticipated to have a CAGR of 4.2% over the period 2022 through 2027, which region will show the greatest growth?

- How has the role of unmanned military ground vehicles grown over the last decade? Is this role anticipated to change? How has technology changed the entire military ground vehicle market?

- The military ground vehicle market incorporates all types of connectors. Which connector types will see the most growth over the next year, two years or even five years?

This report from industry leader Bishop & Associates, addresses these questions and many more.

Copper and Fiber Connectivity in the Data Center

How are high-speed copper and fiber optic interconnect continuing to evolve to support ever-increasing demand for higher bandwidth, signal integrity, longer reach, and increased face plate density while reducing total system power consumption and cost?

- What applications will continue to drive exponential demand for data center capacity and speed? Are active optical cables a long-term solution or a transitional tool between copper and fiber networks? How do thermal management issues impact I/O connector selection?

- What new fiber optic connectors have, or are being developed, to support the many new applications for optical links? Who are the manufacturers developing these and what key features do these interfaces incorporate?

- Have we reached basic technology limits? What is co-packaged optics (CPO) and how does this approach affect power consumption? Panel density?

- How have the current iterations of pluggable optical transceivers changed the market? What are the advantages of using pluggables?

- What are some of the electrical and mechanical limitations associated with using copper? How does cable weight and bulk affect things like weight and cost?

2022 North American Cable Assembly Manufacturers

In North America, the state or province with the most cable assembly manufacturers is California with 186 companies that have a combined 2019 sales value of $3,856 million.

Who can benefit from the report:

- Companies seeking potential subcontractors for the outsourcing of their cable assembly requirements.

- Companies that want to identify potential customers for their products and services, including connector and component suppliers, equipment/tooling suppliers, material suppliers, and distributors.

- Organizations seeking to acquire cable assembly companies can find a comprehensive list of potential targets in the report.

World Automotive Connector Market

Which Automotive Systems are Going to Drive the Growth in the Automotive Sector? What Impact is the Shift to Electric and Hybrid Electric Vehicles having on the Automotive Market Today? Five-Years from Now?

- Will growth of automotive connectors outpace other end-use equipment sectors?

- Which automotive systems and sub-sectors of the automotive connector market will show the greatest growth over the next five-years?

- Which regions and vehicle types are accelerating this growth?

- By automotive system, connector type, and vehicle type, where will the greatest focus lie?

Consistently one of the fastest growing sectors, a result of a worldwide increase in production of both conventional and electric vehicles, the automotive market has recently seen a decline in consumption driven by component shortages. World Automotive Connector Market, examines this evolving market, providing a quantitative and qualitive analysis by region of the world, automotive segment, application, and connector type.

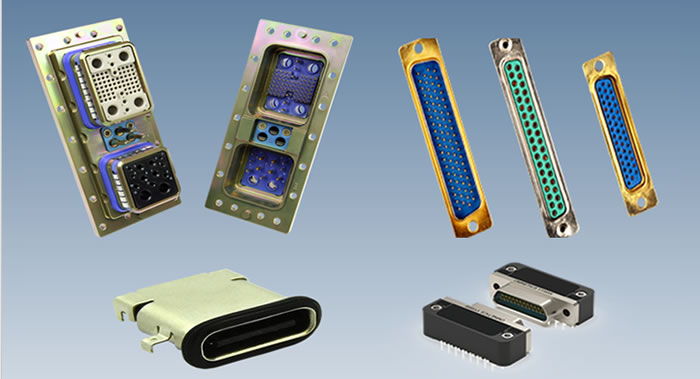

The I/O Rectangular Connector Market 2021

Ranked the third largest connector family in 2021, the I/O rectangular market is expected to account for over 14% of the total world connector market.

- What types of I/O rectangular connectors will make up this thriving product type?

- What type of I/O rectangular connector represented the greatest sales dollars in 2020? What type is anticipated to represent the greatest sales dollars in 2021F? 2026F?

- Which region is the largest consumer of I/O rectangular connectors overall? Which product type within that region? Which region is anticipated to show the largest 5-Year CAGR? Which I/O product type?

- Who are the key manufacturers of SFP (small-form-factor pluggable) connectors? Rack and panel connectors? Personal computer and peripheral connectors?

- What trends are affecting the growth of D-subminiatures? Of rectangular I/O power connectors? Of I/O connectors with blade or tab contacts?

This report examines by region, by general classification, and by individual I/O rectangular connector type the I/O rectangular connector market and provides detailed sales statistics for the years 2019, 2020, 2021F, and 2026F.

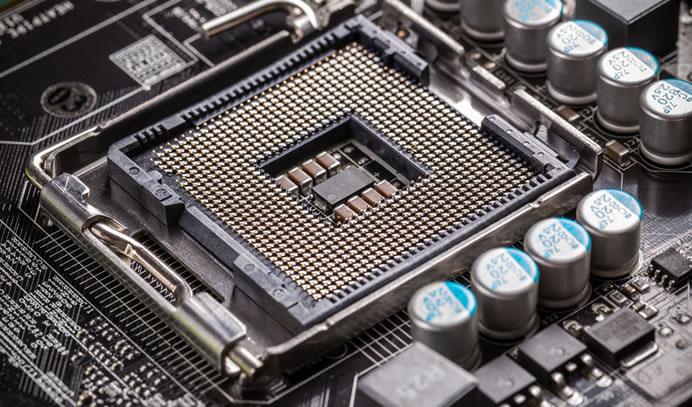

IC Socket Market Systems and Connector Forecast 2020 - 2030

IC sockets have been used for many years for different, evolving reasons. Since sockets add to material costs, no one would use them unless they had a good reason – or are basically following a standard operating procedure that has worked for previous generations.

Over-all, the IC socket market seems relatively healthy, although with generally low single-digit growth rates, and a possible shift in the mix from production to test sockets. And as the semiconductor industry approaches the end on Moore’s Law and seeks out new multichip and 3D chip designs, they will intuitively need more testing.

Then, why, and where is the growth in IC sockets going to occur?

- Which region is going to see the greatest growth in overall IC sockets? Will this growth be In IC sockets used in server applications, in desktop, or notebook applications?

- What is the role of Test and Burn-in (T & BI) sockets? Is this role anticipated to grow or decline?

- Which socket markets are ripe for innovation and why? Will SMT and stacked memory (HMC) technology place pressure on the IC socket market?

Instrumentation Market for Connectors

Instrumentation equipment companies are expanding their technical capabilities, products, and software platforms to meet the need for higher speeds and extremely higher frequencies (EHF) to participate in the next decade of significant growth. This creates opportunity for connector suppliers.

Today, connector companies that are either already in, or are aspiring to enter the instrumentation market, may be contemplating their business strategies, and asking themselves:

- What is the size and expected growth of the instrumentation equipment market, and its most relevant sub-sectors?

- What is the size and expected growth of the instrumentation connector market?

- What are the market and technology factors enabling this growth?

- Who are the top 15 instrumentation equipment manufacturers and what do they offer?

- Who are the top 30 instrumentation connector suppliers and what connectors do they offer?

This report, provides in-depth analysis of the markets, products, and technologies of instrumentation equipment makers and provides examples of connectors used in instrumentation applications by sub-sector.

Computer Server Market Trends and Connector Use 2020-2030

This new report from Bishop & Associates explores the server market. The report discusses the current trends driving server growth and the manufacturers participating in this growth. Also examined are the connectors used in servers and which connector types will experience the most growth, and which will slowly be phased out.

- How has the server market changed over the last decade? How is it anticipated to change in the next decade? Which regions have prospered from this growth and which regions have seen business decline?

- What connector dynamics influence the server market? What role will photonics take in the server market of the future?

- Which server manufacturers are anticipated to show the greatest growth from 2020 to 2030? Which server manufacturers are anticipated to lose market share?

- Which connector types are most predominate in servers? Is this anticipated to change as server architecture changes?

World Industrial Market for Connectors 2021

- How did the pandemic affect the industrial connector market? What are anticipated to be the biggest drivers of productivity and growth in the industrial market over the next five-years? What growth rates can we expect from the industrial market from 2021 through 2026?

- Which segments of the industrial connector market will show the greatest growth and why?

- What are the important megatrends that affected the industrial market even before the pandemic? Will these trends continue to affect the industrial market and in what ways?

- What communication protocols are most prominent in the industrial market sector? By application, which protocols are anticipated to show the greatest growth and why?

- Which connector type is anticipated to show the most growth during the five-year period 2021 through 2026? Which regions will show highest growth rates?

This report explores the technology and products that are driving the growth of the industrial connector market. Forecasts by industrial segment, product type and region are provided, along with five-year compound average growth rate projections.

World Telecom Connector Market 2020 - 2025

IP-based equipment and virtualization is taking over many equipment sectors of the telecom market. Should we rename it the datacom market?

- What factors will contribute to the IP centric trend?

- What factors are driving growth in the market?

- How is 5G changing the equipment landscape?

- Which region will show the greatest increase over the forecast period? Will any of the regions show a decline?

- Within the five primary telecom equipment categories, where is the greatest potential for growth. Which primary equipment category has the greatest potential for a decline over the forecast period?

- Which connector types will benefit most significantly from an increase in telecom equipment sales? Will any connector types see a decrease in demand?

This report analyses connector sales by primary equipment group, equipment type, region, and connector type and provides detailed statistics of the world telecom connector market. Be prepared for the explosive growth in the telecom connector market. Order your copy of the World Telecom Connector Market 2020 – 2025.

Top 50 Medical Interconnect Solutions Companies

The COVID-19 pandemic accentuated the need for safe and efficient healthcare across the globe. Medical interconnect solution providers adapt their strategies, capabilities, and products during these unprecedented times to participate in the next decade of expected growth in the medical device sector.

The medical interconnect solutions market can be described as a high-mix, low-volume market with a high degree of customized, application-specific connectors designed to meet stringent quality requirements, challenging environments, and strict healthcare regulations.

- Who are the top 50 medical connector companies and what makes these companies special?

- What technologies, products and services do the top 50 offer the medical market?

- What is the historical background, size, and focus of the top 50 medical connector companies?

- Do suppliers of medical connectors offer standard or custom products, cable assemblies, sensors, finished devices, or complimentary products?

- In addition to the medical sector, what other industries do these companies serve?

5G Infrastructure - How 5G is Impacting Infrastructure Hardware and Connector Buying Trends

The first wave of broadband changes is in-process and will impact the types of connectors used, who buys them, and how often. The impact will be felt in the mobile infrastructure and through the wireline carrier central office and traditional cable television equipment markets.

- How is the telecom industry breaking from the past to prepare for tomorrow? What role are industry groups playing in the implementation of 5G?

- How will the growing sophistication of radio area networks support connector industry growth?

- What fundamental changes are needed for service providers to profitably provide ongoing service improvements at a reasonable price?

- How will the accelerating adoption of software-defined open-source hardware platforms impact connector sales forecasts for proprietary equipment sets.

- How are mobile and fixed broadband networks being integrated onto shared hardware platforms?

Non-Automotive Transportation Market for Connectors - 2019-2025F

Non-Automotive Transportation Market for Connectors examines the technology, trends, and products that are driving the growth of the various sub-sectors within the transportation market. Forecasts by transportation sector, product type and region are provided, along with five-year compound average growth rate projections. This report examines the following questions, and more.

- Which mode of transportation, rail & rolling stock, commercial air, commercial vehicle, commercial marine, or other accounted for the highest connector sales in 2019? Which mode is anticipated to account for the greatest growth in 2025?

- What trends are driving the growth, or decline, of the commercial air, rail & rolling stock, commercial vehicles or any of the other sub-sectors in the transportation sector? What role are environmental regulations playing in the various sub-sectors? Are these regulations driving the growth of alternative power sources and what are these alternatives?

- Which connector type is anticipated to show the most growth during the five-year period 2020F through 2025F? Which regions will outgrow other regions and what is the background of this growth?

Medical Electronics Market for Interconnect Solutions

This is an equipment sector that places high value on technology, quality, innovation, and material expertise. The medical market for connectors offers major opportunities for both connector industry leaders and the niche manufacturer.

- What trends are driving growth in the medical equipment sector? What role will demographics play in this growth and how will it affect product design and marketing? How has Covid-19 affected the types of equipment being manufactured today? What role will technologies like robotics, 5G Ethernet, mobile health (mHealth), or artificial intelligence play in the growth of the medical equipment sector?

- Who are the major connector suppliers to the medical equipment sector and what types of connector products are they supplying? Who are the major medical equipment manufacturers? What role do government regulations play in the design, marketing, and sale of medical equipment? How do regulations affect export and import demands?

- How important are design features such as low insertion force, non-magnetic materials, polarization and sterilization capabilities, and the ability to handle a variety of contact types, including power, coax, signal, fiber, air, and fluid?

Top 100 Cable Assembly Companies

In 2017, Industry Sales of Cable Assemblies Totaled Nearly $155 Billion!

- Who came out on top?

- What countries were home to these companies?

- What were their total sales by region?

- How much of the industry do the Top 100 represent?

Know your competitors and know your acquisition targets. Who are the biggest companies out there in the worldwide cable assembly industry? How might they impact you or help you?