TE Connectivity reported sales of $3,168 million for the quarter ending December 27, 2019, down -5.4% year-over-year, down -5% organically, and down -4.0% sequentially. FX impact decreased sales by $43 million in the quarter.

Orders in the quarter were $3,241 million, down -2% YOY as reported and -2% organically, and up +1.1% sequentially, resulting in a book-to-bill ratio of 1.02.

Net income for the quarter was $23 million from continuing operations after a $447 million tax expense related to Swiss tax reform.

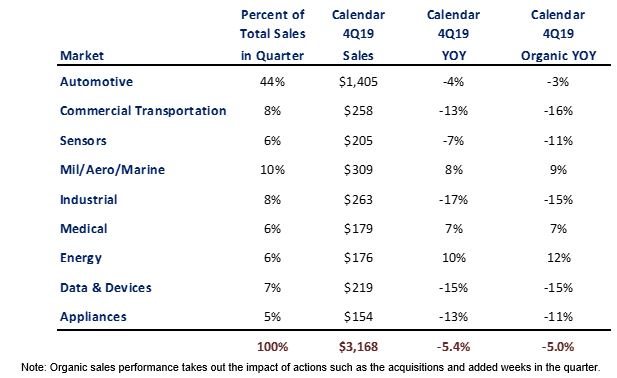

The following is TE’s performance by market sector for calendar 4Q19:

Outlook

TE Connectivity forecasts sales of $3,100 to $3,300 million in CY 1Q20, a year-over-year change of -6.2% actual to midpoint. Versus the prior year, TE is forecasting Transportation and Industrial to be down in the low-single-digits organically, and Communications Solutions to be down low-teens organically versus the prior year.

The full fiscal year outlook for 2020 is for sales of $12,850 to $13,250 million, a year-over-year change of -3% to the midpoint, and down -2% to the organic midpoint. FX headwinds are reducing the sales forecast by $209 million.

Bishop & Associates’ Comments

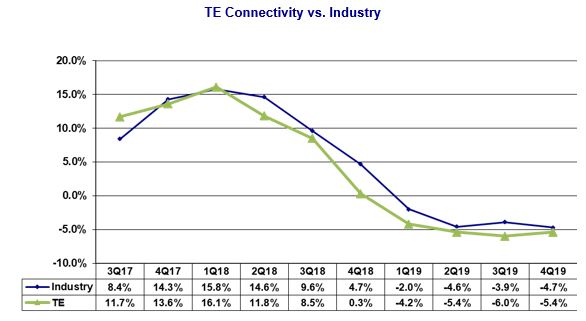

TE’s year-over-year sales decline was -5.4% for CY 4Q19 versus an industry decline of -4.7%. Sales declined in six out of TE’s nine market segments. FX impact reduced the company’s sales performance in the quarter by $43 million.

TE had double-digit declines in four of its market sectors including Commercial Transportation, Industrial, Data & Devices, and Appliances.

The following graph plots TE’s sales performance versus the connector industry by quarter since 3Q17 (year-over-year percentage change).